03/23/22

With such intense increases in home prices across the country since 2011, it’s natural to feel like current home prices are unbelievably high. Surprisingly, a longer-term perspective suggests that today’s home prices aren’t quite as crazy as they feel to some people.

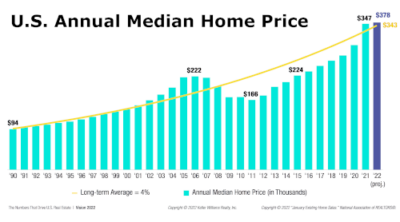

Gary Keller, the co-founder of Keller Williams, the largest real estate sales company in the world, shared this chart with us during his speech at our recent national conference. The curved trend line is the 4% average and healthy annual appreciation the U.S. government economists would like to see nationally. Looking back to 1990, the U.S. followed that curve pretty closely until 2004, where prices started rising significantly above the curve due to lending practices that allowed buyers to borrow money they really couldn’t afford. After the bubble burst, prices fell far below the curve, bottoming out in 2011. Only last year did prices finally rise back to that healthy appreciation curve.

From all this, Gary Keller concludes that we are not in a bubble yet. He believes we have just made up the appreciation lost during the crash. Thus, we’ll most likely see slower appreciation through the remainder of the year unless the government or lenders invoke policies that artificially create more demand.